Sale Leaseback in West Palm Beach

In the dynamic business environment of West Palm Beach, finding creative solutions to improve liquidity, manage assets, and optimize cash flow is key to sustained growth. One such innovative strategy is the Sale Leaseback arrangement. This financial solution enables property owners to sell their real estate to an investor or financial entity, and then lease it back right away, allowing them to retain its use. Essentially, businesses get the capital they need while retaining control over the property they operate in.

Sale Leaseback in West Palm Beach is becoming increasingly popular due to the strong real estate market and the growing demand for flexible financial strategies. Whether you are a business owner looking to free up capital or a real estate investor seeking stable returns, a Sale Leaseback could be an ideal solution to meet your financial goals.

What is a Sale Leaseback?

A Sale Leaseback is a financial arrangement where a property owner sells their asset to an investor or financial institution and simultaneously enters into a lease agreement to continue using the property. This type of deal allows businesses to access the capital tied up in their real estate while maintaining control over the premises they rely on for day-to-day operations.

In a Sale Leaseback agreement, the seller takes on the role of the tenant, while the buyer assumes the position of the landlord. The seller (now the tenant) enters into a lease agreement with the new owner, often for a long-term period. This provides the seller with a steady flow of rental expenses instead of ownership costs, allowing them to redirect the capital into business expansion, debt reduction, or other growth opportunities.

How It Works:

Sale: The business owner sells their property to an investor or financial institution, typically at fair market value.

Leaseback: Simultaneously, the owner signs a lease agreement to continue occupying the property.

Lease Conditions: The lease contract outlines key details, including the rent amount, lease period, and maintenance obligations. Depending on the agreement, the lease can be structured to allow for flexibility or long-term stability.

This strategy is often used by businesses seeking to unlock value from their property without having to relocate or cease operations. It's a win-win for both parties—business owners can free up capital, and investors acquire a property with a reliable income stream through the lease agreement.

Benefits of Sale Leaseback in West Palm Beach

A Sale Leaseback arrangement offers numerous advantages for businesses in West Palm Beach, especially in a market where real estate values are rising and businesses are looking for ways to improve their financial positions. Below are some of the key benefits:

Capital Infusion

A key motivation for businesses opting for a Sale Leaseback is the instant access to capital. By selling the property, businesses can secure a substantial cash influx, which can be utilized to reduce debt, finance new initiatives, or reinvest in operations. This infusion can be especially useful for businesses looking to expand or improve their facilities without taking on additional debt. In West Palm Beach, with its strong economic growth and real estate values, businesses can capitalize on these sales to achieve financial stability and growth.

Tax Advantages

A Sale Leaseback can offer possible tax advantages. Businesses might be able to deduct lease payments as operational costs, thereby lowering their taxable income. Since the property is no longer on the balance sheet, depreciation deductions are no longer available, but the lease expenses may outweigh this in terms of overall tax strategy. For businesses in West Palm Beach, a tax-efficient Sale Leaseback can create significant savings while improving cash flow. Consulting with an expert like Christian Penner PA can help businesses understand how to structure the deal to maximize tax benefits.

Long-Term Lease Stability

After selling the property, businesses still get to operate in the same location under a lease agreement. This ensures long-term stability for companies who rely on the property for operations. In West Palm Beach, where commercial property is in demand, knowing you have a long-term lease allows businesses to plan for the future with confidence, without the risk of having to find a new space.

Improved Liquidity

By selling a property and leasing it back, a business improves its liquidity position. This increased liquidity can be used to meet financial obligations, invest in new opportunities, or improve the company's overall financial health. In a competitive and growing market like West Palm Beach, businesses need the ability to react quickly to new opportunities, and a Sale Leaseback arrangement provides the flexibility to do so.

Offload Ownership Risks

Owning property comes with responsibilities such as maintenance, taxes, insurance, and the risk of depreciation. Through a Sale Leaseback, these ownership responsibilities shift to the buyer, giving the original owner the freedom to focus on business operations without worrying about the long-term maintenance and risk associated with owning property.

Who Can Benefit from a Sale Leaseback?

A Sale Leaseback is a versatile financial tool that can benefit a wide variety of businesses in West Palm Beach. The ability to free up capital while maintaining operational control of property makes it an attractive option for many business owners. Below are some of the key types of businesses that typically benefit from Sale Leaseback transactions:

1. Real Estate Developers

Real estate developers often need large amounts of capital to fund ongoing or new projects. A Sale Leaseback allows them to sell properties that are no longer central to their operations or are in surplus, releasing capital that can be used for new developments. This strategy can help developers in West Palm Beach, where there is constant demand for new properties, continue their business operations without having to take on additional debt.

2. Retailers

Retailers can benefit greatly from Sale Leaseback transactions, especially those who own the property their stores are located in. By selling the store property and leasing it back, retailers gain immediate access to cash, which can be used to expand operations, improve inventory, or invest in marketing campaigns. In the competitive retail environment of West Palm Beach, businesses often need flexibility to adapt, and a Sale Leaseback can be an ideal solution.

3. Manufacturers

Manufacturers, especially those with large factories or production facilities, can benefit from Sale Leasebacks by converting their real estate assets into liquid capital.The capital obtained can be reinvested into the business for purposes such as upgrading equipment, expanding operations, or settling outstanding debt. By continuing to operate in the same location under a lease, manufacturers in West Palm Beach avoid disruptions and can focus on scaling their business.

4. Healthcare Providers

Healthcare providers such as medical centers, hospitals, or large practices that own their buildings can leverage a Sale Leaseback to fund growth or enhance their operations. The healthcare sector typically demands substantial capital for investments, whether it's for adopting new technologies, broadening services, or renovating facilities. A Sale Leaseback provides the capital while allowing them to remain in their current facility, offering continuity of service to patients in West Palm Beach.

5. Educational Institutions

Educational institutions like private schools, universities, and training centers may own large campuses or buildings that are no longer required for their current operations. By selling the property and leasing it back, these institutions can tap into capital that can be reinvested in educational programs, technological advancements, or campus improvements. West Palm Beach, with its growing population, makes it a prime location for educational institutions to benefit from this financial strategy.

6. Large Corporations

For larger corporations with extensive real estate holdings, a Sale Leaseback can be an effective way to release the value of non-core assets without disrupting operations. Corporations can reinvest the proceeds into more lucrative business ventures or use the funds to restructure and streamline operations. In a city like West Palm Beach, with a growing business climate, corporations can capitalize on property values while focusing on their core activities.

7. Small Businesses Looking for Liquidity

Small businesses in West Palm Beach may also consider a Sale Leaseback if they own commercial properties but need capital for expansion or to cover operational costs.This can be a particularly valuable choice for businesses aiming to stabilize their cash flow without incurring additional debt. By selling and leasing back their property, these small businesses can continue to operate with the peace of mind that comes from increased liquidity.

Why Choose Christian Penner PA for Your Sale Leaseback in West Palm Beach?

When considering a Sale Leaseback transaction in West Palm Beach, working with the right advisor is crucial to ensuring the process is smooth, efficient, and financially beneficial. Christian Penner PA offers the expertise, local knowledge, and personalized service that business owners need to navigate this complex financial strategy. Here's why Christian Penner PA is the ideal partner for your Sale Leaseback transaction:

1. Expertise in Sale Leaseback Transactions

With extensive experience in both finance and real estate, Christian Penner PA has gained a thorough expertise in Sale Leaseback transactions. We specialize in helping businesses unlock the full potential of their real estate assets, guiding clients through every step of the Sale Leaseback process—from initial consultation to closing the deal. Whether you are selling a retail property, industrial site, or office space, we have the expertise to structure a deal that meets your unique needs.

2. Local Knowledge and Market Insight

As a trusted advisor in West Palm Beach, Christian Penner PA offers invaluable local insights into the real estate market. West Palm Beach has its own unique characteristics, and a local expert understands how to leverage the city’s current real estate trends to maximize the benefits of a Sale Leaseback. We can help businesses identify optimal sale prices, navigate local zoning laws, and find the right investors who are looking for properties in this growing market.

3. Tailored Solutions for Your Business

At Christian Penner PA, we recognize that every business is different, with its own financial goals and operational needs. That’s why we take the time to understand your business’s unique circumstances before recommending a Sale Leaseback. Our team collaborates with you to create a tailored solution that supports your business objectives, whether it's enhancing liquidity, growing operations, or securing consistent cash flow. We provide customized solutions designed to ensure your long-term success.

4. Full-Service Support Throughout the Process

A Sale Leaseback involves various stages, including property valuation, negotiations, due diligence, and finalizing the lease agreement. Christian Penner PA offers comprehensive, full-service support throughout the entire process, ensuring that all legal, financial, and operational aspects are carefully managed. We assist in negotiating favorable terms, reviewing legal contracts, and ensuring that the deal aligns with your business's objectives.

5. Long-Term Relationships and Trust

At Christian Penner PA, we are dedicated to more than just finalizing transactions. We focus on cultivating lasting relationships founded on trust, openness, and shared success. We understand that West Palm Beach is a competitive market, and our goal is to ensure that your business thrives. Our clients rely on us for continued advice and guidance, long after the Sale Leaseback deal is completed.

6. Commitment to Financial Success

Our main objective is to support your business in reaching its financial goals. By leveraging a Sale Leaseback strategy, businesses can release capital to reinvest into their operations, reduce debt, or expand. We are committed to finding the most effective financial solutions for your needs. Whether you're a small business owner or a large corporation, Christian Penner PA ensures that your Sale Leaseback transaction is structured for optimal financial benefit.

7. Streamlined Process and Stress-Free Experience

The Sale Leaseback process can be overwhelming, but with Christian Penner PA by your side, you can expect a streamlined experience. We take care of all the complexities, so you don’t have to. From negotiating with investors to handling legal documents, we ensure a smooth and stress-free process from start to finish.

If you’re considering a Sale Leaseback in West Palm Beach and want expert guidance throughout the process, Christian Penner PA is here to help. Our team is ready to assist you with every aspect of the transaction, ensuring a smooth, successful experience.

Contact Us Today:

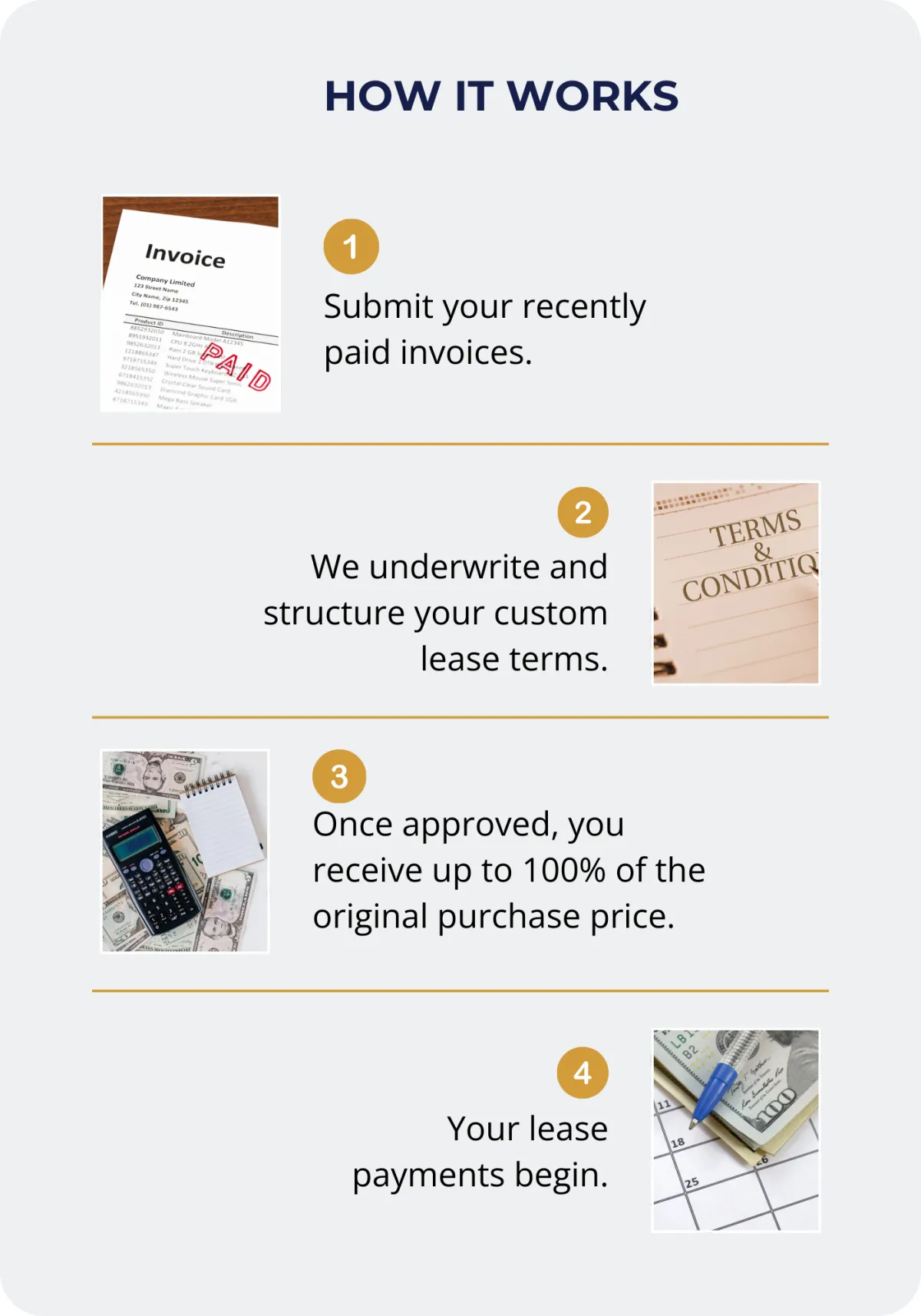

As finance executives balance budget constraints with mission-critical CapEx needs, having cash on hand can be a competitive advantage. Consider how you can monetize your existing assets and improve short-term liquidity with a cash reimbursement, also known as a sale leaseback.

Turn back the clock by revisiting the option to finance your recent equipment purchases.

Combine multiple assets into one streamlined transaction instead of several financing arrangements.

Gain more control of your budget with predictable payments and the ability to align them to the equipment’s useful life.

Explore how a sale leaseback can provide a fast, simple way to put cash back on your books.

GET STARTED

Product Disclosure Statement:

All loan applications are subject to underwriting guidelines, review, and final approval. This communication does not constitute an offer to lend, nor is it a commitment to lend. Not all applicants will qualify for the loan products offered. Loan terms, programs, conditions, and interest rates are subject to change without notice. Fees and costs associated with the loan are governed by applicable state and federal laws, including high-cost loan thresholds. Creditworthiness, income, and collateral are subject to comprehensive review and approval. Loan programs may require a minimum credit score or other specific eligibility criteria. Availability of products and services may vary by state, and certain products may not be offered in all states. Additional terms, conditions, and restrictions may apply. All transactions and equipment financing and leasing are offered through a Third-Party Originator (TPO). Specific products and programs may vary based on the finance company’s guidelines and policies. Equipment financing and leasing are offered by First American Equipment Finance, a subsidiary of City National Bank, and are subject to credit approval by, and documentation acceptable to, First American Equipment Finance.Christian Penner PA is a Licensed Realtor & Commercial Mortgage Broker, and Mortgage Loan Originator, NMLS# 368289.

All rights reserved. ©2024 Christian Penner PA

Copyright © 2026 Christian Penner and its licensors | All Rights Reserved.